Help us stand up to the Trump administration’s efforts to gut two critical rules that require banks to invest in disenfranchised communities and require communities to address housing discrimination.

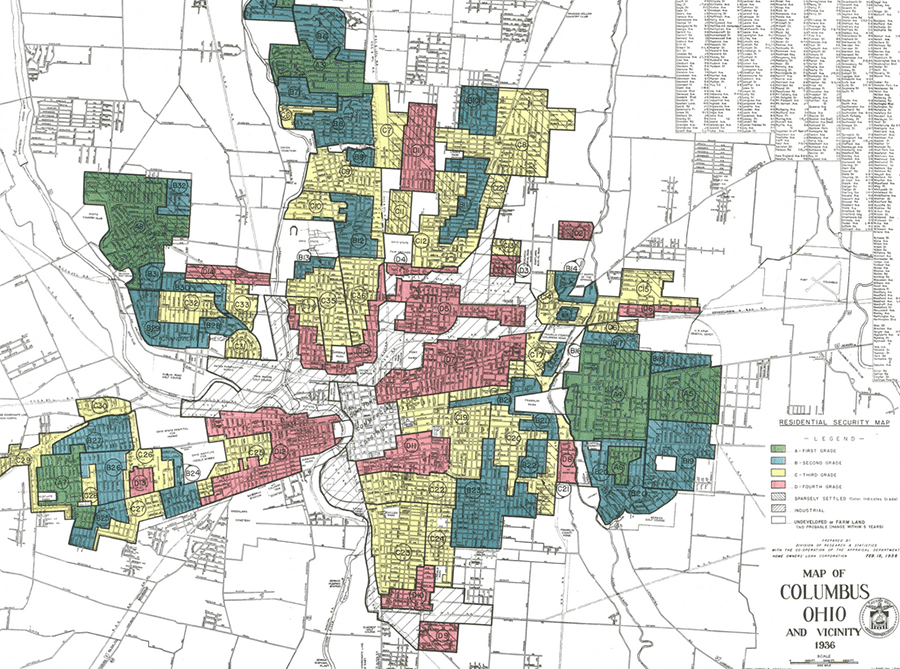

1. Community Reinvestment Act: Congress passed the CRA in 1977 as a attempt to remedy historic redlining and lending discrimination policies. Thanks to these rules, banks have invested $2 trillion in low- and moderate-income communities since 1996.

But now, the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corporation want to “reform” the CRA with new regulations that would undermine the very intent of the law. Instead of requiring banks to make meaningful investments – like affordable housing in low-income neighborhoods – the administration wants to make it easier for banks to comply by giving them credit for investing in things like sports stadiums. For more details, check out this recent Cleveland.com article about the CRA rules.

We’re urging all of our members to submit a public comment opposing the CRA rule change. The National Alliance of Community Economic Development Associations has created an easy online tool to help you voice opposition to modern day redlining before the April 8 deadline.

2. Affirmatively Furthering Fair Housing: HUD is seeking to reverse the AFFH Rule, which would undermine efforts to achieve inclusive, equitable communities.

The purpose of the Fair Housing Law, passed in the wake of Martin Luther King’s assassination, was to prohibit racial discrimination in housing. The law also required local governments to determine if their policies perpetuate segregated housing patterns and actually do something about it.

Developed during the Obama Administration, the AFFH rule provides guidance and tools for communities to identify and address historic patterns of housing segregation, discriminatory practices, and disinvestment. Now HUD wants to replace the 2015 rule with an approach that would be completely ineffective at promoting

fair housing.

Fight for Housing Justice’s website has information and tools that help you quickly submit a personalized comment opposing HUD’s plan to weaken fair housing protections before the March 16 deadline.

Your feedback on both these regulations matter. Each comment these agencies receive will make it a little bit harder for them to defend their efforts to undermine rules on community reinvestment and fair housing is in the public interest.