Column: Trump again demands an absurd and harmful payroll tax cut

Is there no way to get President Trump off his hobbyhorse about a payroll tax cut?

Despite clear evidence that the idea makes no sense whatsoever in the context of the current economic crisis — and would be dead on arrival in the Democratic congressional caucus anyway — Trump keeps returning to it. Most recently, he brought it up Sunday during his appearance on Fox News.

Referring to plans for another stimulus bill, Trump said: “As I told Steve [Mnuchin, the Treasury secretary] just today, we’re not doing anything unless we get a payroll tax cut.”

By pushing to cut off the program’s funding stream, President Trump is taking the first step toward dismantling Social Security.

— Max Richtman, National Committee to Preserve Social Security and Medicare

In all his references to the payroll tax cut over the last few weeks, Trump hasn’t offered any indication that he understands the payroll tax, knows what it’s used for, or why as a tool to get cash into the hands of Americans it would be worse than any other option.

It’s possible that whoever has been putting the idea in his head understands that it would threaten the stability of Social Security, which receives most of the tax, but that’s hardly a comforting thought.

“By pushing to cut off the program’s funding stream, President Trump is taking the first step toward dismantling Social Security,” says Max Richtman, CEO of the National Committee to Preserve Social Security and Medicare.

Is this even a genuine idea in Trump’s mind?

President Trump’s tax reform agenda is in trouble.

House Speaker Nancy Pelosi (D-San Francisco) had a properly skeptical reaction Monday when she was asked about it during an interview with CNN anchor Wolf Blitzer. “I can’t spend a whole lot of time on the quote of the day from the president of the United States,” she said dismissively.

No kudos for Blitzer, however, who kept nattering on about Trump’s comment as though it were (a) serious and (b) intelligent.

“Why is a payroll tax cut a nonstarter?” he asked Pelosi. Moments later, after Pelosi commented that in negotiations for the next stimulus bill, “we’re talking about life and death, we’re talking about people dying, we’re talking about people risking their lives to save people’s lives,” Blitzer came back with, “But what’s wrong with a payroll tax cut?”

He returned robotically to this theme three more times during his 5 1/2-minute encounter with the speaker.

This is how CNN displays its irrelevancy in the debate over the nation’s coronavirus response. Blitzer’s staff, one can safely wager, is capable of independently appraising the wisdom or stupidity of a payroll tax cut and providing its findings to CNN’s audience.

Instead, Blitzer spent more than five minutes trying to back Pelosi into a negotiating position — which if he knows Pelosi at all, he must know was never going to happen. Or perhaps he was trying to take charge of the negotiations himself.

So Blitzer wasted five minutes of his time, Pelosi’s time, and your and my time in this bootless exercise, as though the only thing at stake is whether Pelosi or Trump emerges from the legislative process with bragging rights.

Since CNN appears to be incapable of doing its homework on the payroll tax or thinking for itself, it falls to us to do it for them.

So here, once again, is all that’s wrong with a payroll tax cut.

The highest-earning Americans would get the overwhelming bulk of a payroll tax cut.

To begin with, it would do nothing to help Americans who need the most help. To benefit from a payroll tax cut, a worker must be paying the payroll tax. That’s not happening for the 30 million Americans who have filed for unemployment benefits in the last few weeks, because by definition they’re no longer on a payroll.

The payroll tax cut would have zero benefit for millions of Americans who don’t pay into Social Security, including many state and local workers who aren’t covered by the system, and seniors already receiving Social Security benefits, who are no longer paying the tax.

Moreover, even for many workers still receiving paychecks, the tax cut would be trivial to the point of being nugatory. If the payroll tax of 6.2% were to be cut in half, that would give a household collecting $50,000 a year in wages a benefit this year of $1,550, or about $30 a week.

The tax cut would be poorly targeted. It would go to every wage earner, no matter how affluent. The benefit of the 50% cut would come to $4,269, or $82 a week, for those earning the maximum wage covered by the payroll tax ($137,700 this year).

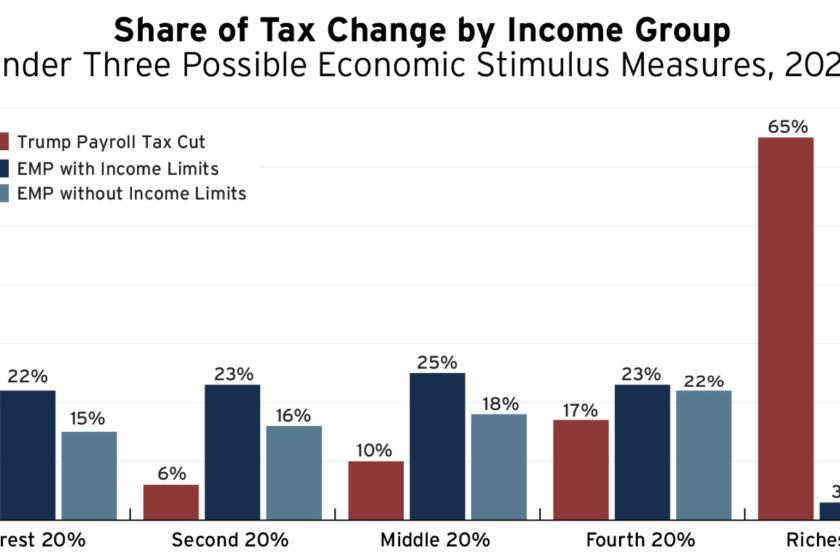

As I reported when Trump first tried to draw a line in the sand in favor of a payroll tax cut, roughly two-thirds of it would go to the rich.

Specifically, according to the Institute on Taxation and Economic Policy, a nonprofit think tank that tracks how taxes and tax breaks are distributed along the income spectrum, 65% of the benefit would go to the top 20% of earners — those making $118,700 or more a year. Fully 25% of the benefit would go to the top 1%. That group collects income of $643,700 or more, with an average income of $2 million.

A payroll tax cut was a bad idea in President Obama’s time, and even worse now.

The poorest 20%, with income below $24,200, would receive only 2% of the benefit. The next poorest 20% would receive 6% of the benefit.

An effective stimulus requires a benefit that is immediate and noticeable. The Economic Stimulus Act of 2008, for instance, provided one-time government checks of up to $1,200 for married couples, including $300 per child.

The payments were phased out starting with household income of $150,000 (for couples), but even low-income households that owed no federal tax were eligible for at least $300, provided they earned at least $3,000 during the year.

Studies later found that recipients pumped as much as 90% of the payments into the economy within three months. As former Federal Reserve Governor Claudia Sahm reported, “Stimulus that is not seen or recognized by individuals is unlikely to affect their sentiment.”

Some supporters of a payroll tax cut point to the cut enacted as a stimulus measure in 2011, during the Obama administration. But that was enacted because Republicans made clear President Obama would have no choice — they flatly rejected every other option. And since they controlled Congress, they got their way.

Obama saw the cut as an unpalatable choice, but it was “the best we could do at the time given the political constraints,” his former economic advisor Jason Furman noted in March, when Trump first started talking about the cut as a coronavirus stimulus option. “But it was far from optimal then and would be even further from optimal now.”

Given its obvious shortcomings as an economic tool, it’s hard not to focus on the subtext of the GOP love for a payroll tax cut. It’s an attack on Social Security, a program Republicans have tried to undermine for all its 85 years.

“Social Security is an earned benefit fully funded by the contributions of workers throughout their working lives,” Richtman informed Trump in an April 24 letter.

“A payroll tax cut or deferral chips away at that fundamental idea, making it easier each time it is enacted to turn to it again to meet some future crisis, until the payroll tax is not just cut or deferred but is eliminated. Undermining the program in this manner would help achieve the goals of opponents of Social Security including those who would privatize the program.”

That’s what this is all about, even if Trump doesn’t know it. Trump whisperers know he has room for no more than one idea in his head on any topic, and once he’s grasped onto it, it’s hard to dislodge. Here are the ideas that need to supplant it: A payroll tax cut won’t help most Americans, it will go mostly to the rich, and it will harm a program that many Trump voters hold dear.

As for its virtues, there are none.