Medical Debt

Medical Debt in Dollars

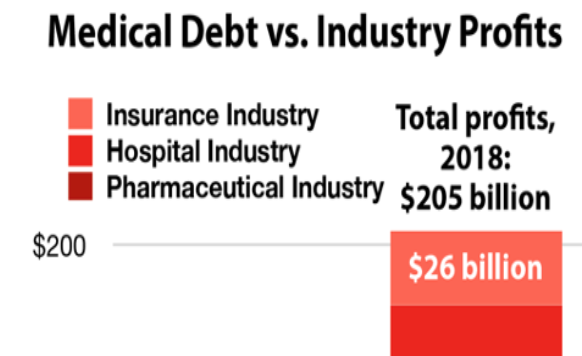

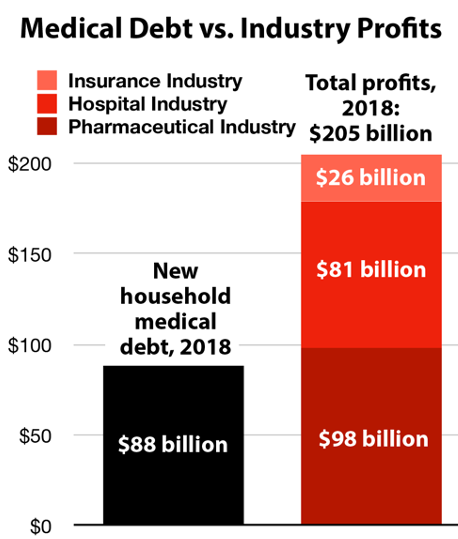

Total amount Americans borrowed to pay for health care, 2018 1

Profits of just 13 American pharmaceutical companies, 2018 2

Hospital industry profits, 2018 3

Health insurance industry profits just through the first three quarters of 2018 4

Pharmaceutical industry profits, 2000-2018 5

Total amount of medical debt seized from patients through debt collection, 2012 6

Average reported medical debt in collection in 2014. 61% of unpaid medical debts in collection are unpaid because people can’t afford them, and the rest because of the bureaucratic complexity of private health care financing: 24% don’t know they owe money and 21% lost track of their bill. 7

Percent of people with medical bill problems whose bill exceeded $10,000 in 2015 8

Percent of those with medical bill problems who’ve had difficulty paying other bills as a result of their medical debt in 2015 9

Number of adults (19-64) who have more than $10,000 in medical debt 10

Number of Americans who borrowed at least $10,000 for healthcare services in 2018 11

1 West Health and Gallup (2019), “The U.S. Healthcare Cost Crisis”

https://news.gallup.com/poll/248081/westhealth-gallup-us-healthcare-cost-crisis.aspx.

2 Belk, David (2020), “Pharmaceutical Financial Index”

https://truecostofhealthcare.org/pharmaceutical_financial_index/

3 Net profits are found by multiplying the hospital industry’s net revenue of $1.1918 trillion (from CMS) by its net profit margin of 6/8% (from MEDPAC). See Centers for Medicare & Medicaid Services (March 24, 2020), “NHE Fact Sheet,” https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NHE-Fact-Sheet; Medicare Payment Advisory Commission (March 2020), “Hospital inpatient and outpatient services,”

http://www.medpac.gov/docs/default-source/reports/mar20_medpac_ch3_sec.pdf?sfvrsn=0

4 According to According to AM Best as cited in Business Wire (March 1, 2019), “Best’s Market Segment Report: U.S. Health Insurance Industry Sustains Strong Earnings Momentum in 2018"

https://www.businesswire.com/news/home/20190301005040/en/Best%E2%80%99s-Market-Segment-Report-U.S.-Health-Insurance

5 Ledley et al. (March 2020), “Profitability of Large Pharmaceutical Companies Compared With Other Large Public Companies,” JAMA

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7054843/

6 LaMontagne, Christina (2014), "Medical debt crisis worsening despite health care policy advances," NerdWallet Health,

https://assets.nerdwallet.com/blog/health/files/2014/10/NerdWallet-Health-study-Medical-debt-crisis-worsening-despite-health-care-policy-advances.pdf.

7 $579 according to the CFPB and 61% according to Consumer Reports. See Consumer Financial Protection Bureau (December 2014), "Consumer credit reports: A study of medical and non-medical collections,” https://files.consumerfinance.gov/f/201412_cfpb_reports_consumer-credit-medical-and-non-medical-collections.pdf.; Wang, Penelope (August 1, 2018), “Sick of Confusing Medical Bills?” Consumer Reports, https://www.consumerreports.org/medical-billing/sick-of-confusing-medical-bills/.

https://files.consumerfinance.gov/f/201412_cfpb_reports_consumer-credit-medical-and-non-medical-collections.pdf.

8 Hamel, Liz (January 5, 2016), "The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey," Kaiser Family Foundation

https://www.kff.org/report-section/the-burden-of-medical-debt-section-3-consequences-of-medical-bill-problems/

10 12% of 193.9 million adults. See Collins, Sara R., Herman K. Bhupal, and Michelle M. Doty (February 2019), “Health Insurance Coverage Eight Years After the ACA: Fewer Uninsured Americans and Shorter Coverage Gaps, but More Underinsured,” Commonwealth Fund

https://www.commonwealthfund.org/publications/issue-briefs/2019/feb/health-insurance-coverage-eight-years-after-aca.

Prevalence of Medical Debt

No one tracks medical debt comprehensively, but credit reports, debt collections and surveys all reveal that a huge portion of the country has been forced to go into debt in order to get health care, transferring enormous wealth from households to health care companies.

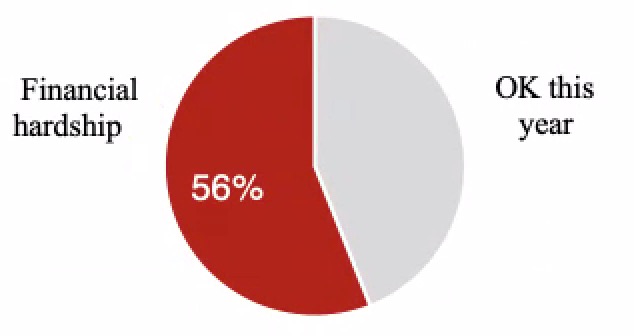

Number of U.S. adults experiencing medical financial hardship every year (56%), defined as medical debt, delaying care because of costs or worrying about medical bills. 79% of these people are insured 12

Percent of people with medical debt who landed in debt despite having health insurance 13

Number of U.S. adults (26%) experiencing “serious financial problems” due to health care costs over a two-year period (2013 to 2015) 14

No. of American adults (1 in 5) contacted each year by a debt collection agency about medical bills 15

Number of adults (1 in 4) paying off medical bills over time 16

Number of Americans with overdue medical debt on their credit reports (1 in 5) 17

Number of U.S. adults every two years (11%) who lose all or most of their savings to medical bills 18

Portion of households carrying credit card debt who cite medical expenses as a factor 19

Percent of total debt collections that come from medical expenses 20

Percent of U.S. household debt created by health care expenses 21

Amount Americans pay for medical debt compared to bank and credit card debt combined 22

Food insecurity rate among kids in households with medical debt compared to houses without debt 23

Portion of low- and middle-income households with medical debt who pay for basic expenses like rent or groceries using credit (borrowing at an average annual rate of 16.75%) 24

Reduction in medical debt among Michigan residents who gained coverage through Medicaid expansion 25

Adults (18-64) still reporting past-due medical debt in 2015 despite the Affordable Care Act 26

Lower likelihood of medical debt among low-income people who gained Medicaid coverage through the “Oregon Medicaid experiment.” They were also 81% less likely to end up with “catastrophic” out-of-pocket health care costs. 27

Reduction in adults (18-64) reporting past-due medical debt in 2015 after the Affordable Care Act expanded Medicaid and insurance subsidies, compared to 2012. In other words, 80.5% of medically indebted families either remained in debt or were not protected from new medical debt. 28

Lawsuits filed by the University of Virginia Health System against patient for $106 million in unpaid medical bills, including its own employees. The hospital company also won the ability to garnish thousands of low-wage workers’ wages and put liens on thousands of patients’ properties. 29

Medical debt erased by Methodist Le Bonheur hospital system for 5,300 low-income patients after an investigation by MLK50 and ProPublica 30

12 According to the Census Bureau, 28,565,542 people are uninsured. (137,100,000 – 28,565,542) / 137,100,000 = 79%. See Yabroff, K. Robin, Jingxuan Zhao, Xuesong Han, and Zhiyuan Zheng (August 1, 2019), “Prevalence and Correlates of Medical Financial Hardship in the USA,” Journal of General Internal Medicine 34, no. 8: 1494–1502, https://link.springer.com/article/10.1007/s11606-019-05002-w.; Census Bureau (2019), “Selected Characteristics of Health Insurance Coverage in the United States (TableID S2701),” 2018 ACS 1-Year Estimates Subject Tables

https://data.census.gov/cedsci/table?q=insurance&tid=ACSST1Y2018.S2701&hidePreview=false

13 Both Karpman and Pollitz find that 70% of people in medical debt had insurance when they incurred the debt. Himmelstein et al. find that the rate is 77.9%. See Karpman, Michael (May 21, 2015), "Most Adults with Medical Debt Had Health Insurance at the Time the Debt Was Incurred," Urban Instiute Health Policy Center, http://hrms.urban.org/briefs/Most-Adults-with-Medical-Debt-Had-Health-Insurance-at-the-Time-the-Debt-Was-Incurred.html; Pollitz, Karen (January 7, 2014), “Medical Debt Among People With Health Insurance,” Kaiser Family Foundation, https://www.kff.org/private-insurance/report/medical-debt-among-people-with-health-insurance/; Himmelstein, David U., Deborah Thorne, Elizabeth Warren, and Steffie Woolhandler (2009), “Medical Bankruptcy in the United States, 2007: Results of a National Study,” The American Journal of Medicine 122, no. 8: 6,

https://doi.org/10.1016/j.amjmed.2009.04.012.

14 According to a survey by NPR, Robert Wood Johnson Foundation and Harvard T.H. Chan School of Public Health, 26% of U.S. adults report “serious financial problems.” According to the Census Bureau, there were 227,019,486 adults 18 and over in 2016. 26% of 227,019,486 is 59,025,066. See NPR et al. (February 2016), "Patients’ Perspectives on Health Care in the United States: A Look at Seven States & the Nation,” https://media.npr.org/assets/img/2016/02/26/PatientPerspectives.pdf.; Census Bureau (October 28, 2016), “Electorate Profiles: Selected Characteristics of the Citizen, 18 and Older Population,”

https://www.census.gov/data/tables/time-series/demo/voting-and-registration/electorate-profiles-2016.html.

16 24.8% of adults 28+ according to Karpman & Caswell and 23% of adults 19-64 according to Collins et al. 23% of 193.9 million adults 19-64 is 44.6 million. See Karpman, Michael & Kyle J. Caswell (March 2017). “Past-Due Medical Debt among Nonelderly Adults, 2012–15,” Urban Institute, https://www.urban.org/research/publication/past-due-medical-debt-among-nonelderly-adults-2012-15; Collins et al. (February 2019), footnote 10.

17 Consumer Financial Protection Bureau (December 11, 2014), “CFPB Spotlights Concerns with Medical Debt Collection and Reporting,”

https://www.consumerfinance.gov/about-us/newsroom/cfpb-spotlights-concerns-with-medical-debt-collection-and-reporting/. https://www.consumerfinance.gov/about-us/newsroom/cfpb-spotlights-concerns-with-medical-debt-collection-and-reporting/.

18 Of the 26% of adults experiencing financial trouble, 42% lose their savings. 26% x 42% = 11.%. See NPR (February 2016), footnote 14. According the Census Bureau, the U.S. population 18+ was 255,271,738 in 2019. 11% x 255,271,738 = 28,079,891; Census Bureau (2020), “Age and Sex (Table ID: S0101),” 2019: ACS 1-Year Estimates Subject Tables

https://data.census.gov/cedsci/table?q=age&tid=ACSST1Y2019.S0101&hidePreview=false.

19 McElwee, Sean, (August 2016), “Enough to Make You Sick: The Burden of Medical Debt,” Demos

https://www.demos.org/publication/enough-make-you-sick-burden-medical-debt

21 "The Impact of Third-Party Debt Collection on the US National and State Economies in 2016." EY Building a Better World (November 2017).

https://www.acainternational.org/assets/ernst-young/ey-2017-aca-state-of-the-industry-report-final-5.pdf?viawrapper

23 Brewer, Mackenzie (2018), “Collateral Damage? How Household Debt Impacts Child Health and Development,” unpublished dissertation, Rice University

https://doi.org/10.3386/w25053.

25 Medical debt in collections. See Miller, Sarah, Luojia Hu, Robert Kaestner, Bhashkar Mazumder, and Ashley Wong (September 2018), “The ACA Medicaid Expansion in Michigan and Financial Health.” Cambridge, MA: National Bureau of Economic Research

https://doi.org/10.3386/w25053.

27 Baicker, Katherine, Sarah L. Taubman, Heidi L. Allen, Mira Bernstein, Jonathan H. Gruber, Joseph P. Newhouse, Eric C. Schneider, Bill J. Wright, Alan M. Zaslavsky, and Amy N. Finkelstein (2013), “The Oregon Experiment — Effects of Medicaid on Clinical Outcomes.” The New England Journal of Medicine 368, no. 18 : 1713–22

. https://doi.org/10.1056/NEJMsa1212321.

29 Hancock, Jay and Elizabeth Lucas (September 10, 2019), “‘UVA Has Ruined Us’: Health System Sues Thousands of Patients, Seizing Paychecks and Claiming Homes,” Kaiser Health News.

https://khn.org/news/uva-health-system-sues-patients-virginia-courts-garnishment-liens-bankruptcy/

30 Thomas, Wendi C. (October 2, 2020), “Profiting from the Poor: What Happens After a Debt Collection Machine Grinds to a Halt,” ProPublica.

https://www.propublica.org/article/what-happens-after-a-debt-collection-machine-grinds-to-a-halt

Bankruptcy

Medical bills are the single biggest factor forcing Americans to file for personal bankruptcy 31

Portion of family bankruptcies (67%) related to medical costs 32

Households declaring bankruptcy each year because of direct medical costs or job/income losses due to a medical condition 33

Percent of people declaring bankruptcy because of medical costs who had private insurance 34

Average out-of-pocket costs among families declaring bankruptcy for medical reasons, 2007 35

Percent of household bankruptcies caused at least in part by medical debt before and after the Affordable Care Act was implemented (in 2013 and in 2014-2015, respectively). The Affordable Care Act, drafted with cooperation from the health care industries, did almost nothing to rein in hospital, drug, and medical device prices, to streamline the administrative costs produced by multiple insurers, or to rein in premium, deductibles, and out-of-network fees for most people who have private insurance. 36

Average net worth of households declaring medical bankruptcy in 2007 37

31 Cahn, Susan (February 19, 2020), "Millions of Americans Donate through Crowdfunding Sites to Help Others Pay for Medical Bills,” NORC at the University of Chicago

, https://www.norc.org/NewsEventsPublications/PressReleases/Pages/millions-of-americans-donate-through-crowdfunding-sites-to-help-others-pay-for-medical-bills.aspx

32 Himmelstein, David U., Robert M. Lawless, Deborah Thorne, Pamela Foohey, and Steffie Woolhandler (March 2019), “Medical Bankruptcy: Still Common Despite the Affordable Care Act,” American Journal of Public Health 109, no. 3: 431–33

https://doi.org/10.2105/AJPH.2018.304901.

Who Has Been Indebted

Portion of people with medical debt who have private, employer-sponsored insurance 38

Portion of people without insurance, people with private insurance and people with Medicaid, respectively, who carry medical debt 39

Higher rate of medical debt among people on private insurance compared to people on Medicaid 40

Workers at firms with over 500 employees have outstanding medical debt 41

Percent of cancer patients forced into medical debt to get treatment 42

Percent of people declaring medical bankruptcy who lost or had to quit a job because of a medical event 43

Percent of households with medical debt who own less than $1,000 in liquid assets. These households have 164% higher odds of having medical debt than wealthier households 44

Percent of low-income adults reporting debt from care that was not covered by a health plan 45

Percent of middle-income adults who had medical debt in 2014 (compared with 25.6% lower income and 15.4% higher income) 46

Black Americans (age 18-64) with medical debt 47

Range of nonelderly adults reporting past-due medical debt across states, ranging from 5.9% in Hawaii to 37.4% in Mississippi 48

Portion of states with the highest rates of past-due medical debt that are in the South 49

Portion of seniors who have to pay more for out-of-pocket medical expenses than they have in non-housing assets in the last five years they’re alive. 25% have to pay more than their total assets. 50

Median out-of-pocket expense seniors living past age 95 have to pay after they pass their 70th birthday. The 95th percentile has to pay an average of $269,000. 51

39 Gunja, Munira Z., Sara R. Collins, David Blumenthal, Michelle M. Doty and Sophie Beutel (April 2017), “How Medicaid Enrollees Fare Compared with Privately Insured and Uninsured Adults: Findings from the Commonwealth Fund Biennial Health Insurance Survey, 2016,” The Commonwealth Fund

https://doi.org/10.15868/socialsector.27290

41 Salary Finance (2020), “Inside the Wallets of Working Americans – The 2nd Annual Salary Finance Report"

https://www.salaryfinance.com/us/2020-report/.

42 Gilligan, Adrienne (October 1, 2018), "Death or Debt? National Estimates of Financial Toxicity in Persons with Newly-Diagnosed Cancer," The American Journal of Medicine

https://www.amjmed.com/article/S0002-9343(18)30509-6/fulltext

44 Brewer, Mackenzie (2018), “Collateral Damage? How Household Debt Impacts Child Health and Development,” Rice University

https://scholarship.rice.edu/bitstream/handle/1911/105782/BREWER-DOCUMENT-2018.pdf.

50 Kelley, Amy S., Kathleen McGarry, Sean Fahle, Samuel M. Marshall, Qingling Du, and Jonathan S. Skinner (2010), “Out-of-Pocket Spending in the Last Five Years of Life,” National Bureau of Economic Research Bulletin on Aging and Health, no. 2: 3,

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3612877/pdf/nihms-313129.pdf.

51 Sudipto Banerjee (April 3, 2018), “Cumulative Out-of-Pocket Health Care Expenses After the Age of 70,”

https://www.ebri.org/health/publications/issue-briefs/content/cumulative-out-of-pocket-health-care-expenses-after-the-age-of-70.

Health Care Price Hikes

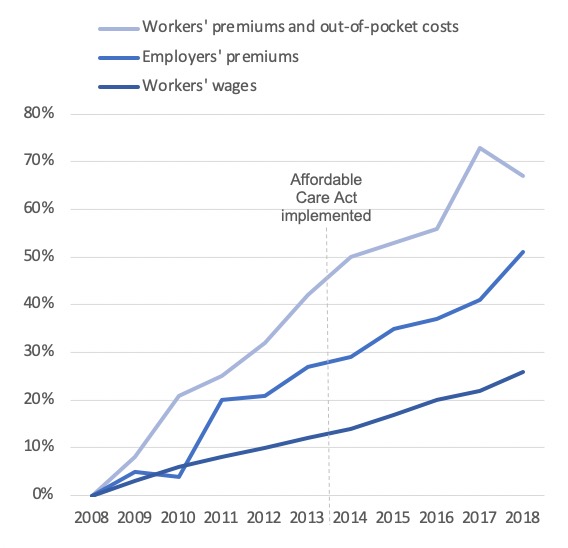

Percent increase in premiums for employer-sponsored insurance plans from 2008 to 2018. Workers’ average earnings increased during the same period by just 26%. 52

Projected growth in national health care expenditures, 2020-2027, at a 5.5% annual rate 53

Median wage growth, 2019 to 2020 54

Average increase in health care prices for patients and employers, 2019 to 2020 55

Average annual growth in workers’ premiums for employer-sponsored insurance plans from 2015 through 2018. Employers’ premiums increased by between 3.8% and 7.1% each year. 56

Average increase in drugs prices, 2019 to 2020 57

Average increase in the price of hospital expenditures, 2017 to 2020 58

Projected growth in households’ total out-of-pocket health expenses from 2020 to 2028 (growing at an annual rate of 4 to 4.3%) 59

Portion of adults (39%) who cannot afford an unexpected expense of $400. 27% would have to borrow money or sell something to afford the bill, and 12% wouldn’t be able to afford it at all. 60

Average annual cost of employer-sponsored insurance for a family of four in 2018 (including $15,159 in employer-paid premiums, which reduce workers’ pay, plus $7,726 paid directly by workers for premiums and out-of-pocket costs) 61

Out-of-pocket maximum allowed by the ACA for a family plan in 2020 62

52 Rae, Matthew (August 14, 2019), “Tracking the rise in premium contributions and cost-sharing for families with large employer coverage,” Peterson-KFF Health System Tracker

https://www.healthsystemtracker.org/brief/tracking-the-rise-in-premium-contributions-and-cost-sharing-for-families-with-large-employer-coverage/

53 Sisko, Andrea M., Sean P. Keehan, John A. Poisal, Gigi A. Cuckler, Sheila D. Smith, Andrew J. Madison, Kathryn E. Rennie, and James C. Hardesty (March 2019), “National Health Expenditure Projections, 2018–27: Economic And Demographic Trends Drive Spending And Enrollment Growth,” Health Affairs 38, no. 3: 491–501

https://doi.org/10.1377/hlthaff.2018.05499.

54 “Salary Budget Survey.” WorldatWork Total Rewards Association (July 8, 2019).

). https://www.worldatwork.org/docs/research-and-surveys/sbs/SBS2019_20_TopLevelData_NonParticipants.pdf

55 Girod, Christopher. "2020 Milliman Medical Index." Milliman (May 21st, 2020)

https://us.milliman.com/en/insight/2020-Milliman-Medical-Index

56 Centers for Medicare and Medicaid Services (2019), “Table 24: Employer-Sponsored Private Health Insurance,” 2018 National Health Expenditure Data

https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NationalHealthAccountsHistorical.

57 Hopkins, Jared. “Drug prices rise 5.8% on average in 2020.” Market Watch (January 2, 2020).

https://www.marketwatch.com/story/drug-prices-rise-58-on-average-in-2020-2020-01-02

59 Centers for Medicare and Medicaid Services (April 14, 2020), “Table 5: Personal Health Care Expenditures by Source of Fund,” 2019-2028 National Health Expenditure Projections

https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NationalHealthAccountsHistorical.

60 Board of Governors of the Federal Reserve System (May 2019), “Report on the Economic Well-Being of U.S. Households in 2018,”

https://www.federalreserve.gov/publications/files/2018-report-economic-well-being-us-households-201905.pdf.

61 Rae, Matthew, Rebecca Copeland, and Cynthia Cox (August 14, 2019), “Tracking the Rise in Premium Contributions and Cost-Sharing for Families with Large Employer Coverage,” Peterson-KFF Health System Tracker

https://www.healthsystemtracker.org/brief/tracking-the-rise-in-premium-contributions-and-cost-sharing-for-families-with-large-employer-coverage/.

62 “Out-of-pocket maximum/limit.” Healthcare.gov (2020)

https://www.healthcare.gov/glossary/out-of-pocket-maximum-limit/#:~:text=For%20the%202019%20plan%20year,and%20%2415%2C800%20for%20a%20family.

Surprise Medical Bills

Percent of American adults who have received unexpectedly expensive medical bills 63

Insured adults under 65 who receive an unexpected medical bill each year 64

Portion of insured adults with major medical bills in the last two years who had a billing problem like higher-than-expected charges, unclear statements, and bills arriving months late 65

Portion of insured adults with major medical bills in the last two years who ended up paying bills they weren’t even sure they owed because their coverage and bills were too confusing 66

Portion of adults under 65 with employer-sponsored insurance from a big employer who are billed out-of-network charges each year 67

People with unaffordable out-of-network medical bills who had no idea their provider was out-of-network. The other 3 in 10 knew but had limited options 68

Percent of Americans worried about unexpected medical bills 69

Nationwide portion of in-network admissions that led to an out-of-network bill from a surgeon, anesthesiologist or other provider 70

Portion of in-network hospital admissions billed with out-of-network charges in Alabama, California, Maryland, Nevada, New Jersey, and Texas. In Florida and Kansas, the rate is 1 in 4. In Minnesota, it is just 1.7%. 71

Portion of emergency department and independent lab charges, respectively, billed out-of-network to patients at in-network hospitals 72

Portion of elective inpatient visits for which patients receive a surprise medical bill 73

Portion of ambulance rides that are out-of-network. 26% of patients taking ambulances end up being billed out-of-network 74

Portion of inpatient hospital and emergency department admissions for which hospitals billed patients out-of-network in 2016, up from 27% (inpatient) and 32% (E.D.) in 2010 75

Likelihood an emergency inpatient admission was billed out-of-network, 2017 76

Percent of inpatient admissions that resulted in at least one out-of-network charge, 2017 77

Portion of total household out-of-pocket medical spending that goes to hospitals. Much larger amounts go to physicians, dental care, nursing care, prescription drugs, and medical equipment and supplies 78

Portion of mothers billed out-of-network for delivering their first baby 79

Portion of women on private insurance plans who regularly take prescription medicine yet in the last 12 months either had to pay a higher co-insurance or copay or had their insurance company drop coverage of their prescription altogether 80

Portion of privately insured Pennsylvanians who receive a surprise bill and tried to resolve the bill before paying it. Only 1 in 4 were able to do so satisfactorily 81

Although the Affordable Care Act places on annual cap on in-network out-of-pocket costs that patients have to pay, there is no legal limit on how much providers and insurers can charge through balance billing and out-of-network charges. 82

Portion of Americans supporting legislation to protect patients from surprise medical bills, 2017 83

Amount spent on television ads in 2019 by two private equity firms, Blackstone Group Inc. and KKR & Co., to block legislation protecting patients from surprise medical bills 84

Bills passed by Congress to protect privately insured patients from surprise billing by hospital, insurance, lab, and other health care companies. Public insurance programs, including Medicare, Medicaid, and the VA, protect people from surprise billing 85

64 Pollitz, Karen, Matthew Rae, Gary Claxton, Cynthia Cox, and Larry Levitt (February 10, 2020), “An Examination of Surprise Medical Bills and Proposals to Protect Consumers from Them,”

https://www.healthsystemtracker.org/brief/an-examination-of-surprise-medical-bills-and-proposals-to-protect-consumers-from-them-3/.

68 Pollitz, Karen (March 2016), “Surprise Medical Bills,” Kaiser Family Foundation

, https://www.kff.org/private-insurance/issue-brief/surprise-medical-bills/

71 Kevin Kennedy, William Johnson and Jean Fuglesten Biniek (March 28, 2019), “Surprise Out-of-Network Medical Bills during in-Network Hospital Admissions Varied by State and Medical Specialty, 2016,” Health Care Cost Institute,

https://healthcostinstitute.org/out-of-network-billing/oon-physician-bills-at-in-network-hospitals.

73 Garmon, Christopher, and Benjamin Chartock (January 2017), “One In Five Inpatient Emergency Department Cases May Lead To Surprise Bills,” Health Affairs 36, no. 1: 177–81

https://doi.org/10.1377/hlthaff.2016.0970.

75 Sun, Eric C., Michelle M. Mello, Jasmin Moshfegh, and Laurence C. Baker (August 12, 2019), “Assessment of Out-of-Network Billing for Privately Insured Patients Receiving Care in In-Network Hospitals,” JAMA Internal Medicine.

https://doi.org/10.1001/jamainternmed.2019.3451.

78 Center for Medicare and Medicaid Services (December 17, 2019), “Table 04 National Health Expenditures by Source of Funds and Type of Expenditures (2018),”

https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NationalHealthAccountsHistorical.

79 Chartock, Benjamin, Christopher Garmon, and Sarah Schutz (March 2019), “Consumers’ Responses To Surprise Medical Bills In Elective Situations.” Health Affairs 38, no. 3): 425–30

https://doi.org/10.1377/hlthaff.2018.05399.

80 Kaiser Family Foundation (March 2018), “Coverage, Access, and Affordability: Key Findings from the 2017 Kaiser Women’s Health Survey,”

http://files.kff.org/attachment/Issue-Brief-Womens-Coverage-Access-and-Affordability-Key-Findings-from-the-2017-Kaiser-Womens-Health-Survey.

81 Altarum Health Care Value Hub (June 2019), “Many Privately-Insured Pennsylvanians Receive Unexpected Medical Bills; Fully One-Third Unhappy with Resolution, May Not Understand Options for Assistance,"

," https://www.healthcarevaluehub.org/advocate-resources/publications/many-privately-insured-pennsylvanians-receive-unexpected-medical-bills-fully-one-third-unhappy-resolution-may-not-understand-opt

82 “Out-of-pocket maximum/limit.” Healthcare.gov (2020).

https://www.healthcare.gov/glossary/out-of-pocket-maximum-limit/#:~:text=For%20the%202019%20plan%20year,and%20%2415%2C800%20for%20a%20family.

84 Dezheimer, Elizabeth (January 8, 2020), “Blackstone-KKR Hidden Hand in Ad Blitz Unleashes Washington Fury,” Bloomberg

https://www.bloomberg.com/news/articles/2020-01-08/blackstone-kkr-hidden-hand-in-ad-blitz-unleashes-washington-fury.

85 Hoadley, Jack, Kevin Lucia, and Katie Keith (April 2, 2020), “Keeping Surprise Billing Out Of Coronavirus Treatment,” Health Affairs Blog

https://www.healthaffairs.org/do/10.1377/hblog20200330.353921/full/.

Crowdfunding to Cover Medical Bills

86 Advisory.com (July 10, 2018), "1 in 3 GoFundMe campaigns is for medical bills, CEO says,"

https://www.advisory.com/daily-briefing/2018/07/10/gofundme

87 Helhoski, Anna (November 2, 2016), "Just 11% of Medical Crowdfunding Campaigns Are Fully Funded, Study Finds,” Nerdwallet.

https://www.nerdwallet.com/blog/studies/study-few-medical-campaigns-funded-bankruptcy/