ST. PAUL — Businesses that pulled down federal Paycheck Protection Program loans and Minnesotans who received additional weekly unemployment insurance benefits last year could see tax relief under a proposal getting pieced together in the Legislature.

The Senate Tax Committee on Tuesday, March 2, greenlit a change to a conformity bill that would let tax filers that drew additional $600 weekly unemployment benefits subtract some of that amount from their taxable income. The addition has been a priority for Democratic legislators at the Capitol and could be a step forward in getting a compromise plan through the divided Legislature.

More than 100,000 businesses received PPP loan funds last year and used the aid to help keep employees on their payrolls despite the downturn in business spurred by COVID-19 and state efforts to curb it.

"We are in an unusual time, we need to get this bill moving," said Senate Tax Committee Chairwoman Carla Nelson, R-Rochester, who is supporting tacking on an amendment exempting some of the additional unemployment benefits. “We do have 67 senators who I believe are laser-focused on trying to help their constituents recover."

Members of the panel said they were also considering bundling additional funding for summer school programming with the bill that they hope to pass early this month. Gov. Tim Walz and Democratic leaders have said the funding is crucial to building back learning time lost as students went into distance learning models.

ADVERTISEMENT

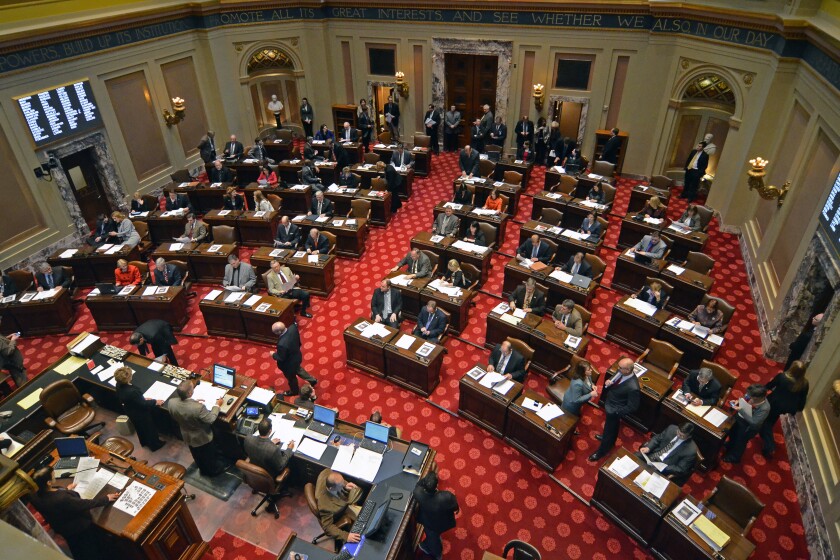

The bill moves now to the full Senate but Nelson and the bill's author Sen. Tom Bakk, I-Cook, indicated more changes could be on the way as Senate Majority Leader Paul Gazelka, R-East Gull Lake, and House Speaker Melissa Hortman, D-Brooklyn Park, seek to negotiate a bill that could get it through the Republican-led Senate and DFL-controlled House of Representatives.

“I am hopeful that Leader Gazelka and Speaker Hortman can find an additional provision to this bill that will make it really bipartisan,” Bakk said. "I'd really like to get this bill to the governor's desk before the 15th of March and, unfortunately, this committee can't do it on its own."

Some business owners face a March 15 filing deadline without state intervention to make state tax codes match up with federal ones. And lawmakers have been under pressure to change the policies in time to prevent any issues.

House Tax Committee Chairman Paul Marquart, D-Dilworth, in January brought forth a conformity bill that mirrored Bakk's original bill and on Tuesday said he was hopeful about the movement to reach a deal.

Marquart said he recommended that legislative leaders find ways to build in targeted supports for businesses that were hardest hit, including those that took out the loans and reported net operating losses last year. And he urged them to include relief for Minnesotans that drew unemployment benefits.

"We need to take action on the PPP conformity but I also want to make sure that we help all businesses and unemployed workers," Marquart said. " I don’t want to leave any of those businesses that are getting hurt behind."

Under the Senate's amended bill, individuals could subtract up to $1,500 in additional unemployment payment income from their taxable income. And joint filers could have up to $3,000 exempted. The waived taxes could cost the state between $30 million and $50 million, per an analysis.

The broader tax conformity for businesses that received PPP loans carries a price tag of about $440 million in the next budget cycle. News last week of a projected $1.6 billion budget surplus helped jumpstart conversations about how to spend one-time funds.

ADVERTISEMENT

Follow Dana Ferguson on Twitter @bydanaferguson , call 651-290-0707 or email dferguson@forumcomm.com